Used Vehicle Value Index

Quarterly Conference Call

The next quarterly Manheim Used Vehicle Value Index (MUVVI) conference call is scheduled for Tuesday, Jul 9 at 11am ET.

Join Cox Automotive Chief Economist Jonathan Smoke, Jeremy Robb, senior director of Economic and Industry Insights, and Scott Vanner, Economic and Industry Insights analyst, as they discuss the latest Manheim Used Vehicle Value Index and the major economic and industry trends that shaped the quarter.

All questions related to the Manheim Used Vehicle Value Index and wholesale market can be sent to manheim.data@coxautoinc.com.

Listen to a recording of the last call.

View the Most Recent Presentation

The presentation will be available one hour before the conference call.

View Previous Presentations

By applying statistical analysis to its database of more than 5 million used vehicle transactions annually, Manheim has developed a measurement of used vehicle prices that is independent of underlying shifts in the characteristics of vehicles being sold. View the index methodology.

The Manheim Index is increasingly recognized by both financial and economic analysts as the premier indicator of pricing trends in the used vehicle market, but should not be considered indicative or predictive of any individual remarketer’s results.

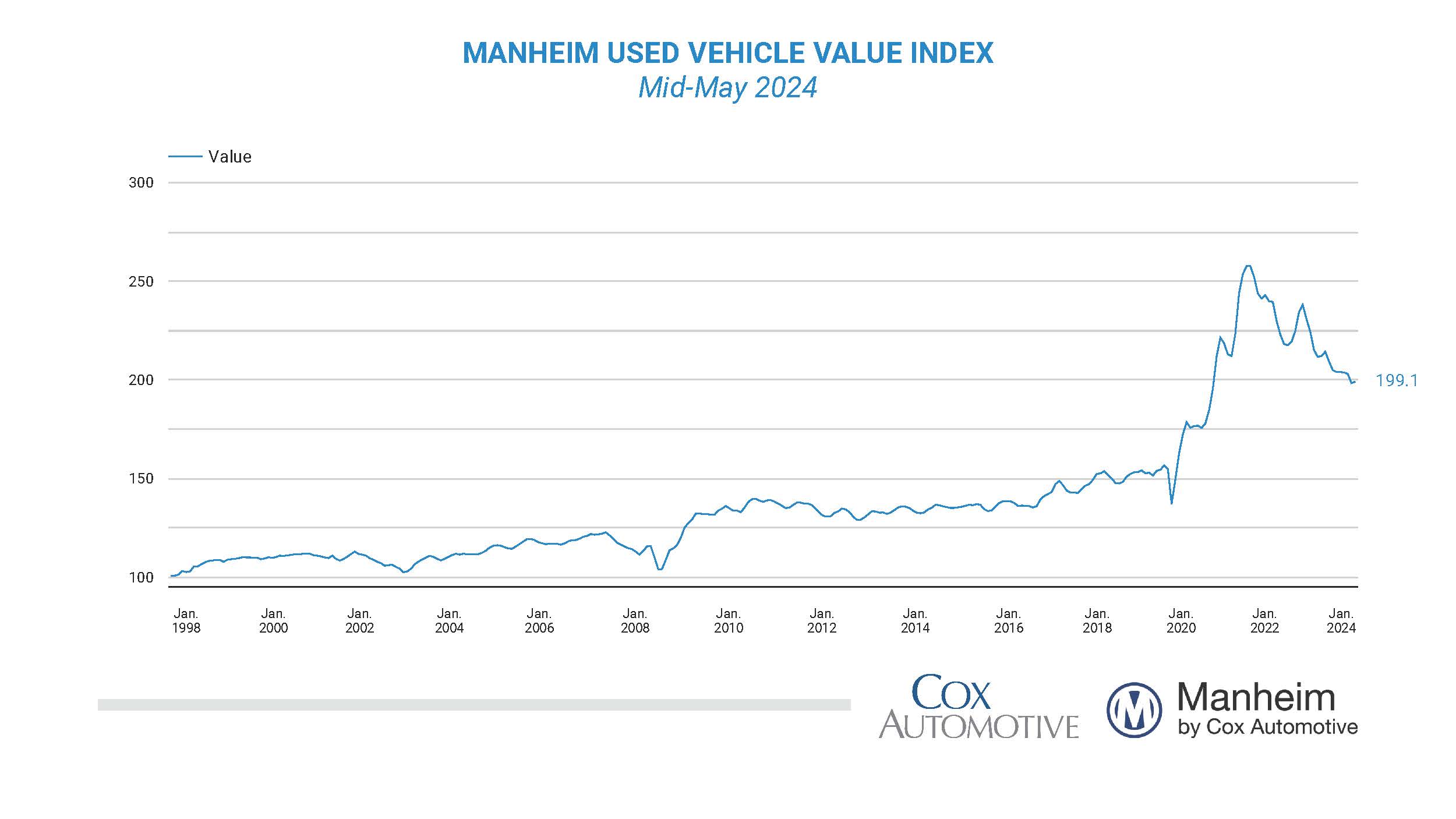

Wholesale Used-Vehicle Prices Increase in First Half of May

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.3% from April in the first 15 days of May. The mid-month Manheim Used Vehicle Value Index rose to 199.1, which was down 11.3% from the full month of May 2023. The seasonal adjustment mitigated the results for the month. The non-adjusted price change in the first half of May declined 0.3% compared to April, while the unadjusted price was down 10.6% year over year.

“Although we saw stronger declines in April against what is normal, declines in vehicle values have decelerated in early May,” said Jeremy Robb, senior director of Economic and Insights at Cox Automotive. “Over the last two weeks, we’ve seen slightly higher sales conversion at Manheim, which has helped to slow the declines in wholesale value trends at the start of the month.”

Over the last two weeks, Manheim Market Report (MMR) prices in the Three-Year-Old Index decreased an aggregate of 0.9%, which was slightly above the typical normal decline observed of 0.8% at this time of year. Over the first 15 days of May, MMR Retention, the average difference in price relative to current MMR, averaged 98.7%, indicating that valuation models are lagging market prices. MMR retention is down two-tenths of a point against the prior year at the beginning of May. The average daily sales conversion rate of 59.3% in the first half of the month was below the May 2019 daily average of 59.9%. The conversion rate has risen half a point from April 2024, indicating that we are seeing a bit stronger buying demand at wholesale markets over the past two weeks.

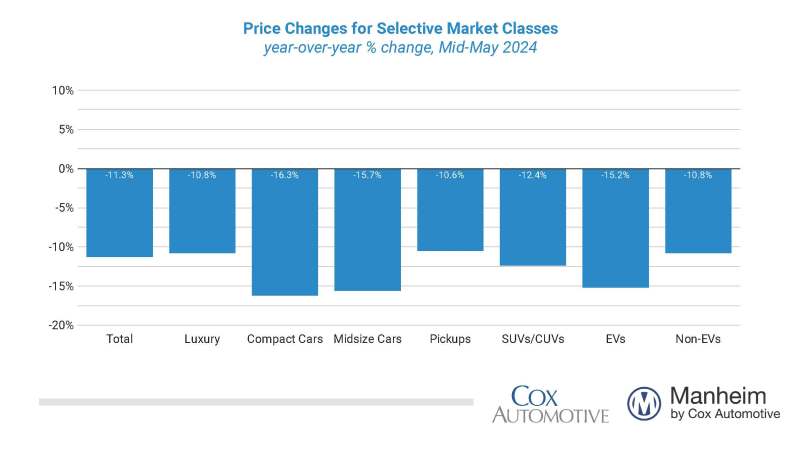

All major market segments saw seasonally adjusted prices that remained lower year over year in the first half of May. Compared to the industry’s year-over-year decline of 11.3%, the pickup and luxury segment outperformed the index overall, with pickups down 10.6% and luxury falling by 10.8% against 2023. Performing worse than the industry, SUVs were down 12.4%, midsize cars fell by 15.7%, and compacts declined 16.3% year over year. Additionally, all major segments except pickups showed price declines compared to April. The industry overall rose 0.3% against the prior month, and pickups increased 1.0% over the same period. Faring worse, SUVs were down slightly, falling by just 0.1%, luxury was down 0.7%, compact cars declined by 0.9%, and midsize cars fell by 1.2% against April 2024. Electric vehicles (EVs) were down 15.2% against values for May 2023, while the non-EV segment declined by 10.8% over the same period. Compared to April, non-EVs showed no change in the first half of May, while EVs were down 1.4% over the same period.

Wholesale supply is flat in mid-May. Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended April at 25 days, up one day from the end of March and up one day compared to April 2023. Wholesale supply is relatively normal for this time of year. As of May 15, wholesale supply was flat against the end of April at 25 days and up one day year over year. However, wholesale supply remains down one day compared to 2019.

Rental risk prices declined in the first two weeks of May. The average price for rental risk units sold at auction in the first 15 days of May was down 13.5% year over year. Rental risk prices also declined by 0.5% compared to the full month of April. Average mileage for rental risk units in the first half of May (at 57,300 miles) was down 2% compared to a year ago and fell by 2.5% against April 2024.

Consumer sentiment is down in May. The initial May reading on Consumer Sentiment from the University of Michigan fell 12.7% to 67.4, which was the lowest level since November. Both future expectations and views of current conditions declined similarly. Expectations for inflation both in one year and in five years increased. Consumers’ views of buying conditions for vehicles fell to the lowest level yet this year but remained better than a year ago. Consumers’ view of vehicle prices improved slightly, but the view of interest rates deteriorated. The daily index of consumer sentiment from Morning Consult continues to be volatile but improved last week. Sentiment declined 1.6% in April but was up 0.3% over the last week, though it is down 0.8% so far in May as of the 15th. Sentiment is up only 0.1% year to date. The average unleaded gas price, according to AAA, declined 1.2% over the last week to $3.60 per gallon as of May 15, which was up 2% year over year and up 15.8% year to date. In May, gasoline prices are down 1.7%.