Market Insights

Providing Data-Backed Insights on the Wholesale and Used-Vehicle Markets

Manheim delivers the world’s largest wholesale marketplace through a network of 111 physical, digital and mobile auction locations with 650+ digital lanes, serving more than 80,000 dealers. Every year, 8 million vehicles are offered for sale to dealers, and Manheim facilitates used-car transactions representing nearly $80 billion in value.

The Cox Automotive Economic and Industry Insights team analyzes the trove of data from Manheim transactions through the wide lens of additional data available across Cox Automotive to offer thoughtful analyses on the used wholesale and retail markets.

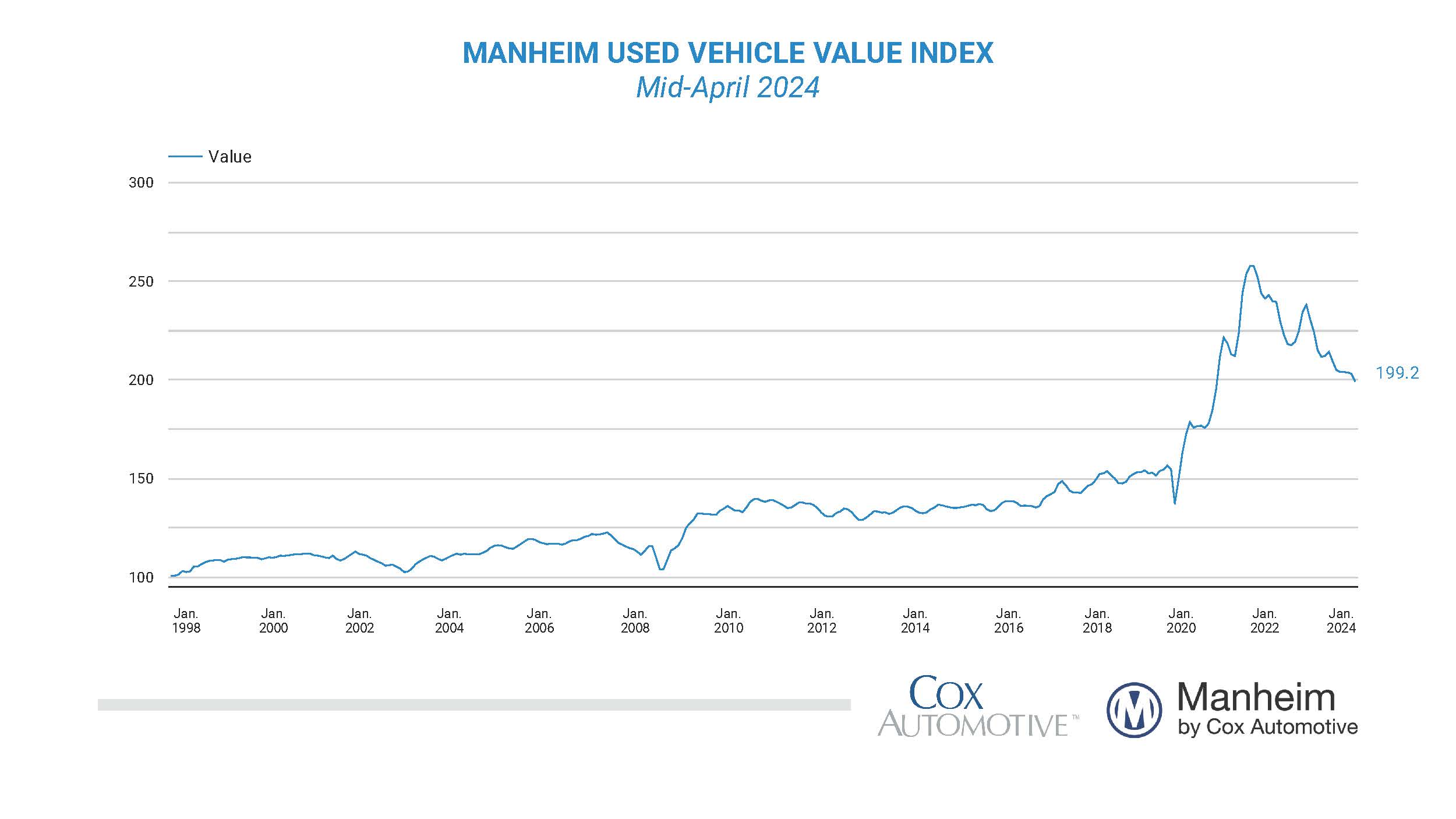

Manheim Used Vehicle Value Index (MUVVI): An industry benchmark, the MUVVI is a measurement of wholesale used-vehicle prices that is independent of underlying shifts in the characteristics of vehicles being sold. Published on the fifth business day of each month, the MUVVI serves as an early indicator of what will be seen in the retail used market. See the full Manheim Used Vehicle Value Index.

Manheim Used Vehicle Value Index

199.2 ⇓13.7%

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) decreased by 1.9% from March during the first 15 days of April. The mid-month Manheim Used Vehicle Value Index dropped to 199.2, which was 13.7% lower than the full month of April 2023. The seasonal adjustment amplified the results. The non-adjusted price change in the first half of April declined by 0.2% compared to March, while the unadjusted price was down 11.6% year over year. This was the first time the Manheim index reading has been under 200 since March 2021, illustrating the outsized moves in the index over the last three years

Manheim Market Insights Video

This video provides a quick analysis of the used wholesale and retail markets, encompassing data and insights across the Cox Automotive ecosystem. This video is published each month after the mid-month MUVVI check-in is released, which covers the first 15 days of the month. Watch the latest Manheim Market Insights Video.

Looking for more data and insights?

Visit the Cox Automotive Newsroom for additional data, insights and perspectives on the economy and auto industry. Have data or insight questions or requests? Contact the team at manheim.data@coxautoinc.com.